$2000 Direct Deposits Feb 2026:As the 2026 tax filing season continues, many Americans are closely watching their bank accounts and IRS refund trackers. For a large number of households, tax refunds are not extra or bonus money. Instead, they are often used to pay rent, cover medical expenses, handle school costs, or clear debts from the past year. With everyday expenses still high, knowing when a refund might arrive has become very important for many families.

Unlike stimulus checks or government benefit payments, tax refunds do not follow one fixed payment date. Each refund is processed individually by the IRS, which means timing can vary from person to person. This year, the IRS is using familiar systems, but it has increased identity checks and continues to encourage digital filing to reduce errors and fraud.

Why Refund Timing Matters in 2026

Tax refunds play a quiet but important role in the U.S. economy. Most taxpayers receive some form of refund, and the average amount is often several thousand dollars. For low- and middle-income households, this money is usually spent on necessities rather than luxury items. In 2026, this pattern continues as wages struggle to keep up with rising prices.

यह भी पढ़े:

$2000 Federal Direct Deposit for All – Feb 2026 New Payment Schedule & Eligibility Conditions

$2000 Federal Direct Deposit for All – Feb 2026 New Payment Schedule & Eligibility Conditions

Refund timing matters because families rely on predictability. While the IRS does not guarantee exact refund dates, it generally follows a consistent processing pattern. Understanding how this process works helps taxpayers plan bills and avoid stress caused by rumors or misinformation found online.

How the IRS Processes Tax Returns

Once a tax return is submitted, the IRS begins reviewing it through automated systems. Electronic returns are processed faster because they enter the system immediately. The IRS software checks income details against employer records, confirms eligibility for credits, and looks for any mismatches. When everything matches correctly, the refund can move forward quickly.

Some returns require extra review. Returns that include refundable credits, such as credits for low-income workers or families with children, are legally required to go through additional checks. Identity verification has also become more common. While these steps help prevent fraud, they can slow down refunds for certain taxpayers.

Filing Method and Refund Delivery Speed

The way a tax return is filed has a major impact on how fast a refund arrives. Electronic filing remains the fastest and most reliable option. It reduces mistakes and allows taxpayers to track their refund status sooner. Paper returns must be handled manually, which can add several weeks to processing time.

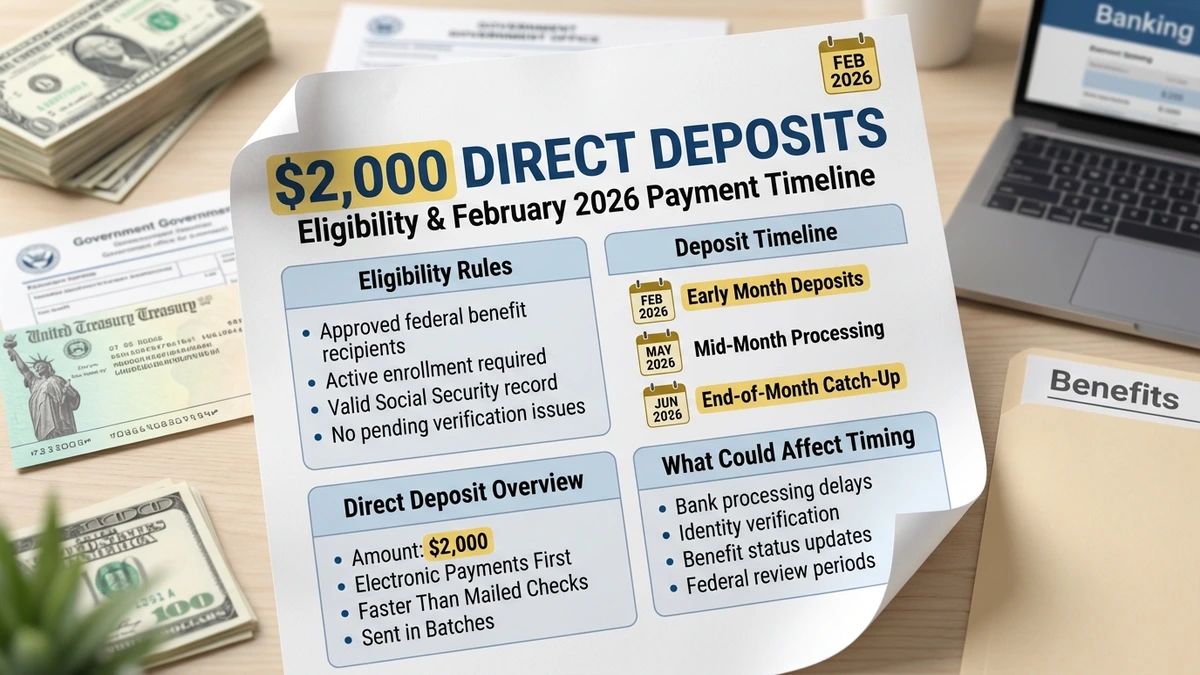

Refund delivery choice also matters. Direct deposit is still the quickest way to receive a refund after it is approved. Many refunds arrive within days of approval when direct deposit is used. Paper checks take longer and can be delayed by mail issues or incorrect addresses.

Who Receives Refunds Earlier

Historically, taxpayers who file early and have simple returns are usually paid first. Those who submit accurate returns in late January or early February often receive refunds by mid to late February. As the season progresses and more returns enter the system, processing times can slow down.

People with more complex tax situations may wait longer. This includes taxpayers with freelance income, investments, or multiple credits. Delays do not usually mean a problem; they often mean the IRS is carefully reviewing the return.

What to Expect for the Rest of the 2026 Tax Season

Compared to previous years affected by the pandemic, the 2026 tax season is more stable. IRS staffing and technology have improved, but the agency remains cautious due to past fraud issues. Refunds are more predictable, though not necessarily faster.

Taxpayers who file early, double-check their information, and choose direct deposit are still the most likely to receive refunds without long delays. While patience is required, understanding the process can help reduce anxiety and improve financial planning during tax season.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS refund amounts, eligibility, and processing timelines may vary based on individual circumstances, filing accuracy, and IRS procedures. Readers should refer to official IRS resources or consult a qualified tax professional for personalized guidance.